A Downshift in Multifamily Development Creates Opportunities

The boon of multifamily development deliveries spurred by historically low interest rates in the early 2020s is reaching its peak (or has already peaked) in several markets, according to CBRE. As new apartment completions slow, all eyes have turned to the rapidly thinning apartment construction pipeline across the United States.

Photo: Stafford House | Columbus Ohio

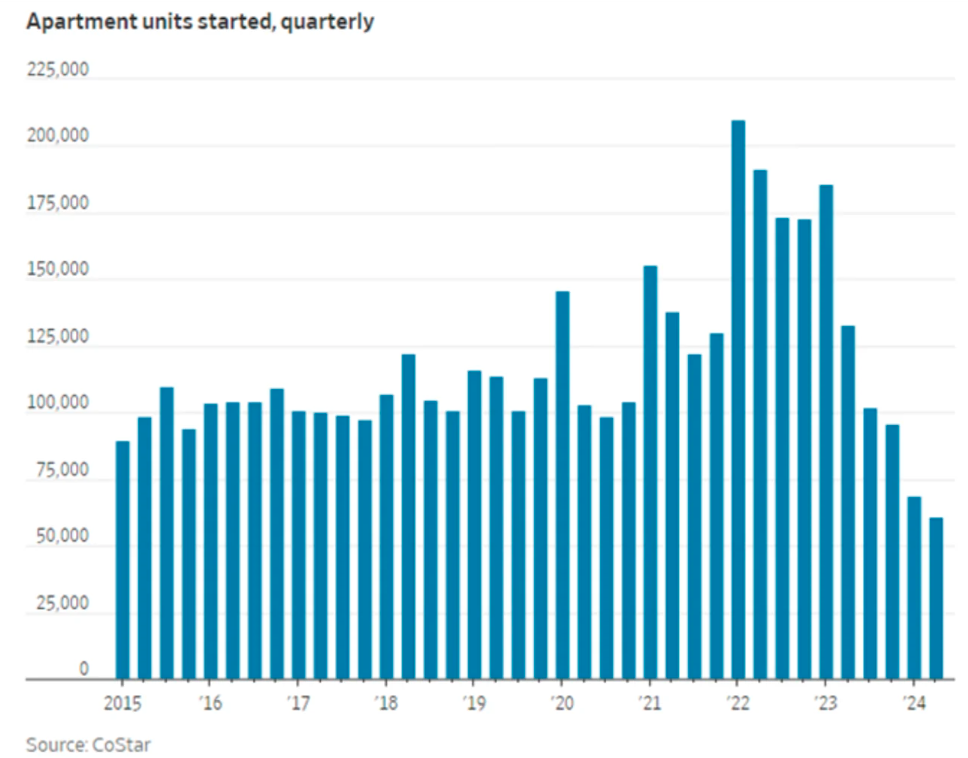

As cited by the US Census Bureau, the annual pace of multifamily building construction starts was down 22% in July 2024 compared to July 2023, and down 41% compared to the April 2022 peak. Further illustrated in the chart below, property data company CoStar has tracked less than 61,000 apartment units started in the second quarter of 2024, which is the lowest number of units started in a quarter over the last decade.

According to data from CoStar, the markets in which Birge & Held owns properties collectively had a 73% decrease in construction starts in Q3 2024 compared to the same quarter last year. Two of our most concentrated markets, Indianapolis and Columbus, had a 97% and 40% decrease, respectively. Also of note is Austin, TX, where asking rents have fallen more than any other market due to an oversupply, and is now the city with the largest decrease in construction starts.

Photo: Springmarc | San Marcos, Texas

What does this mean for investors?

PROMISING PHASE FOR INVESTORS IN THE MULTIFAMILY HOUSING MARKET

The multifamily housing market is entering a promising phase for investors, as a slowdown in new construction, combined with the current state of the nation’s housing affordability (or lack thereof), is poised to create an environment ripe for rent growth and strong returns. With fewer new projects breaking ground, a tightening supply is expected to drive demand for existing properties, positioning investors to benefit from increasing occupancy rates and rental income.

OPPORTUNITIES FOR VALUE CREATION

Industry veterans have been eyeing this opportunity for value creation, with Brookfield, Blackstone, and KKR all buying billion-dollar portfolios of multifamily units earlier this year. ‘The influx of new supply is likely to taper off after 2025, at which point we are optimistic about rent growth,’ KKR reported in April.

The Growing Demand for Apartments

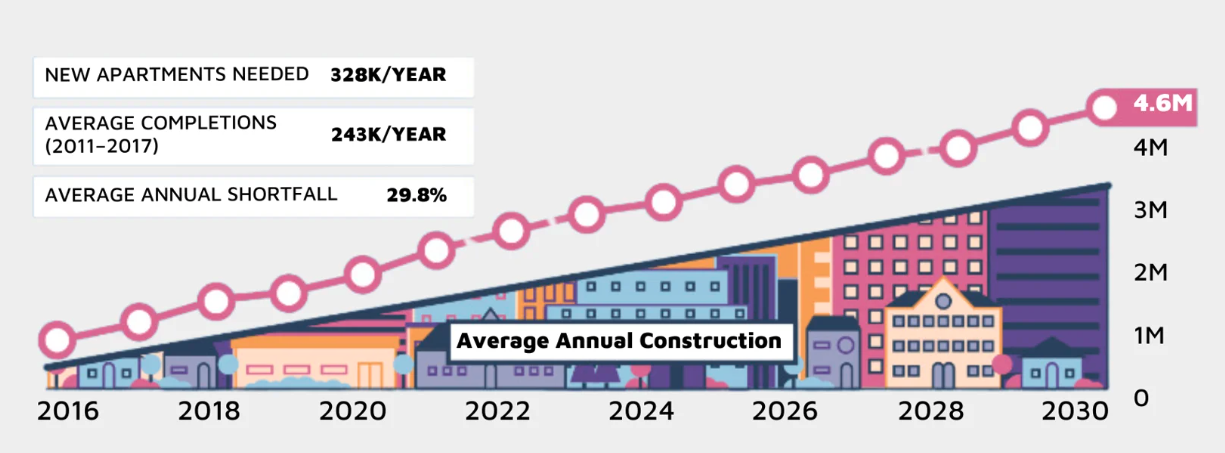

Supply and demand trends tracked by the National Multifamily Housing Council (“NMHC”) since 2016 forecast the need for 4.6 million more apartments by 2030, which equates to 328,000 apartments that need to be added to the national supply annually. Stated simply – the demand for apartments is outpacing supply. On average, from 2011 to 2017, only 243,000 apartments were completed annually, indicating an average annual shortfall of 29.8%.

Supply and demand trends tracked by the National Multifamily Housing Council (“NMHC”) since 2016 forecast the need for 4.6 million more apartments by 2030, which equates to 328,000 apartments that need to be added to the national supply annually. Stated simply – the demand for apartments is outpacing supply. On average, from 2011 to 2017, only 243,000 apartments were completed annually, indicating an average annual shortfall of 29.8%.

The current environment presents a prime time for multifamily investments, with potential for steady income and capital appreciation as supply tightens and demand stays strong. Now is the time for savvy investors to capitalize on these market dynamics and position themselves for success in the multifamily sector.